how to input real data into arima model?

hello

I am a beginner of arima, and wanna ask some question

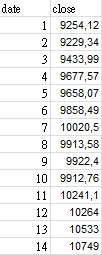

after I found the arima (1,0,1) coefficients, how can I actually use them into real data like below in excel:

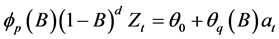

I've read many of the articles, they only provide the original algebra equation,

something like this, which I wanna know is how to use in pratical.

If I am gonna predict the price of date 15, which column should multiply which coefficient to make the result come out?

Thanks very much

Best Answer

-

earmijo

Member Posts: 271

earmijo

Member Posts: 271  Unicorn

Unicorn

Your estimated model is:

Y(t) = 4.17 + 0.70* Y(t-1) + e(t) - 0.71* e(t-1)

This means you need a series for Y(t) and another one for e(t). It looks to me the program you are using is Stata (and some in this forum will ask : Why didn't you ask the question in a Stata forum).

You can get the series for the residual ( e(t) above) using:

predict r, resid

Now plug in the values and you'll get your forecast.

Of course, you could directly get the forecast in Rapidminer or in Stata with the appropriate command.

predict r, resid

0

Contributor I

Contributor I

Answers

hello @marielong - welcome to the User Community. Did you do a search for "ARIMA" in the "Search the community..." bar above? There is a thread on exactly this question that has been taking place for the past week (http://community.rapidminer.com/t5/Getting-Started-Forum/How-future-predictions-can-be-made-with-a-Time-Series-model-in/m-p/42249#M1002) as well as a KB article.

Hope that helps.

Scott

Hello earnijo, thanks for your kindness

It came out like this

date15 value= 4.17 + 0.70*10749 - 0.71* 217,555 = 7427,35

is it right?

so if the predicted price is so far from the real date 15 value(10662,8), can it be said that my model (1 0 1) is wrong?

Hello scott, thanks for help

Marielong:

Your computation is correct. But I would not use the prediction of one observation as a sign of failure (or success if it was really close). You can get lucky. The difference between your prediction and the actual value (if the model is true) is e(t). By definition e(t) cannot be forecast.

If you had more observations (many more than one), you could compare the performance of different models using a metric like the out-of-sample RMSE.

Dear earmijo,

thanks for you reply again, it was helpful

But I still have some questions about the model since I am only a beginner, still seeking for your help.

e(t) comes from newer actual value - older actual value, it should be correct

1.if e(t) = my "r" column, why you've mentioned e(t)=actual value - predicted value, but not =newer actual value - older actual value like in "r' column?

2.I'm a bit confused eg:

date actual value predicted value

1 10 12

2 21 22

3 30 31

e(t) case 1: actual newer - older = 30 - 21 = 9

case 2: actual - predicted = 30 - 31 = -1

it seems a quite big difference, there's why I can't understand

which case should I use?

3.if case 2, to make model like (1 1 1), it has to find a series of e(t) first to compute the equation, but how to figure out e(t) as the predicted value is an unknown?

4.if the model is (1 1 0), the AR coefficient is negative, the result comes out will be negative too, so that the model is wrong?

5.if the model is (0 1 1), means MR coefficient x e(t-1), but the residual must be much smaller than the actual value, so it comes out the result predicted value will be very small, the model goes to false too?

Sorry that I have many questions.

Thank you very much earmijo

this is really helpful!

follow your steps, finally I made these (1 1 1) & (3 1 1), btw how can I preidct the price of 4594-4599 in stata?

I have tried "add new observeration to time series", then use "predict yhat313" but couldn't figure it out